Ronni Jeppesen ApS — Credit Rating and Financial Key Figures

Credit rating

Company information

About Ronni Jeppesen ApS

Ronni Jeppesen ApS (CVR number: 38335960) is a company from Høje-Taastrup. The company recorded a gross profit of -2.4 kDKK in 2023. The operating profit was -2.4 kDKK, while net earnings were 7.4 kDKK. The profitability of the company measured by Return on Assets (ROA) was 3.1 %, which can be considered weak and Return on Equity (ROE) was 3.1 %, which can be considered weak. The equity ratio, a key indicator for solidity, stood at 65.9 %, a level that can be considered to be good. This shows that a large part of the company's assets are funded by shareholders' equity, reducing financial risk. Ronni Jeppesen ApS's liquidity measured by quick ratio was 2.9 which is at a very high level. Thus, the company demonstrates exceptional financial stability, possessing a significant surplus of liquid assets over its short-term liabilities.

Financial information

See financialsGross profit (kDKK)

EBIT (kDKK)

Profitability

Solidity

Key figures (kDKK)

See financials2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|

| Volume | |||||

| Net sales | |||||

| Gross profit | -13.85 | 98.73 | 135.58 | -17.08 | -2.42 |

| EBIT | -13.85 | 98.73 | 135.58 | -17.08 | -2.42 |

| Net earnings | -73.62 | 85.70 | 106.91 | 6.73 | 7.37 |

| Shareholders equity total | 35.18 | 120.88 | 227.78 | 234.52 | 241.89 |

| Balance sheet total (assets) | 439.03 | 336.81 | 545.94 | 383.88 | 366.96 |

| Net debt | 388.56 | 62.06 | -42.88 | -14.58 | -4.53 |

| Profitability | |||||

| EBIT-% | |||||

| ROA | -23.2 % | 25.5 % | 31.6 % | -2.1 % | 3.1 % |

| ROE | -102.3 % | 109.8 % | 61.3 % | 2.9 % | 3.1 % |

| ROI | -26.6 % | 31.1 % | 65.8 % | -4.1 % | 4.9 % |

| Economic value added (EVA) | -7.69 | 93.09 | 99.49 | -21.42 | -12.57 |

| Solvency | |||||

| Equity ratio | 8.0 % | 35.9 % | 41.7 % | 61.1 % | 65.9 % |

| Gearing | 1147.9 % | 62.0 % | |||

| Relative net indebtedness % | |||||

| Liquidity | |||||

| Quick ratio | 1.1 | 1.6 | 1.7 | 2.6 | 2.9 |

| Current ratio | 1.1 | 1.6 | 1.7 | 2.6 | 2.9 |

| Cash and cash equivalents | 15.28 | 12.92 | 42.88 | 14.58 | 4.53 |

| Capital use efficiency | |||||

| Trade debtors turnover (days) | |||||

| Net working capital % | |||||

| Credit risk | |||||

| Credit rating | BB | BB | BB | B | BB |

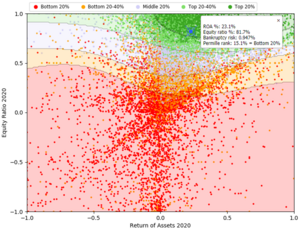

Variable visualization

Roles

Companies in the same industry

Create your own estimates for any company

Valuation analysis

See instructions

... and more!

No registration needed.