ENVI-CON ApS — Credit Rating and Financial Key Figures

Credit rating

Company information

About ENVI-CON ApS

ENVI-CON ApS (CVR number: 32092942) is a company from KOLDING. The company recorded a gross profit of -18.3 kDKK in 2023. The operating profit was -18.3 kDKK, while net earnings were -4563.8 kDKK. The profitability of the company measured by Return on Assets (ROA) was 125.5 %, which can be considered excellent but Return on Equity (ROE) was -984.5 %, which can be considered poor. The equity ratio, a key indicator for solidity, stood at -99.9 %. This indicates that the company's debt surpasses the value of its total assets, posing significant financial risk. ENVI-CON ApS's liquidity measured by quick ratio was 0 which is at a very low level. Thus, the company is in an unstable financial position, with its liquid assets significantly undermatching its current liabilities. This severe liquidity deficiency may lead to financial distress and threaten the company's operational continuity.

Financial information

See financialsGross profit (kDKK)

EBIT (kDKK)

Profitability

Solidity

Key figures (kDKK)

See financials2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|

| Volume | |||||

| Net sales | |||||

| Gross profit | -14.00 | -12.00 | -14.00 | -13.00 | -18.34 |

| EBIT | -14.00 | -12.00 | -14.00 | -13.00 | -18.34 |

| Net earnings | -13.00 | -13.00 | -14.00 | -13.00 | -4 563.76 |

| Shareholders equity total | 965.00 | 952.00 | 937.00 | 924.00 | -3 639.20 |

| Balance sheet total (assets) | 3 570.00 | 3 571.00 | 3 572.00 | 3 573.00 | 3.17 |

| Net debt | -2.00 | -8.00 | -12.00 | -12.00 | -0.01 |

| Profitability | |||||

| EBIT-% | |||||

| ROA | -0.4 % | -0.3 % | -0.4 % | -0.4 % | 125.5 % |

| ROE | -1.3 % | -1.4 % | -1.5 % | -1.4 % | -984.5 % |

| ROI | -1.3 % | -1.3 % | -1.5 % | -1.4 % | -987.8 % |

| Economic value added (EVA) | -45.41 | -43.61 | 117.45 | 119.41 | 114.72 |

| Solvency | |||||

| Equity ratio | 27.0 % | 26.7 % | 26.2 % | 25.9 % | -99.9 % |

| Gearing | |||||

| Relative net indebtedness % | |||||

| Liquidity | |||||

| Quick ratio | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Current ratio | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Cash and cash equivalents | 2.00 | 8.00 | 12.00 | 12.00 | 0.01 |

| Capital use efficiency | |||||

| Trade debtors turnover (days) | |||||

| Net working capital % | |||||

| Credit risk | |||||

| Credit rating | BBB | BBB | BBB | BBB | BB |

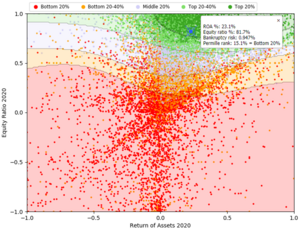

Variable visualization

Roles

Companies in the same industry

Create your own estimates for any company

Valuation analysis

See instructions

... and more!

No registration needed.