New AI-Powered Free Company Valuation tool for any company in the world. Upload a PDF financial statement to receive an instant report with customizable forecasts, credit score, default probability and key financial metrics. Try Now for Free →

- Get an AI-powered company valuation or credit risk report in just 2 minutes

- Get reports of any company in the world with a financial statement in any language

- Upload a PDF financial statement to receive an instant report with customizable forecasts, credit score, default probability and key financial metrics

Anne Lentz Ejendomme ApS — Credit Rating and Financial Key Figures

Credit rating

Company information

About Anne Lentz Ejendomme ApS

Anne Lentz Ejendomme ApS (CVR number: 37537349) is a company from BALLERUP. The company recorded a gross profit of 435.2 kDKK in 2024. The operating profit was 351.1 kDKK, while net earnings were -187.2 kDKK. The profitability of the company measured by Return on Assets (ROA) was 1.4 %, which can be considered weak but Return on Equity (ROE) was -1.1 %, which can be considered poor. The equity ratio, a key indicator for solidity, stood at 43.9 %, a level that can be considered to be modest. This means a balanced mix of debt and equity financing its assets—a typical operational level for many companies. Anne Lentz Ejendomme ApS's liquidity measured by quick ratio was 2.5 which is at a very high level. Thus, the company demonstrates exceptional financial stability, possessing a significant surplus of liquid assets over its short-term liabilities.

Financial information

See financialsGross profit (kDKK)

EBIT (kDKK)

Profitability

Solidity

Key figures (kDKK)

See financials2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Volume | |||||

| Net sales | |||||

| Gross profit | 669.05 | 502.34 | 570.71 | 509.46 | 435.16 |

| EBIT | 504.62 | 420.12 | 488.50 | 425.39 | 351.09 |

| Net earnings | 334.05 | 151.12 | 259.18 | 32.41 | - 187.21 |

| Shareholders equity total | 11 138.30 | 15 061.44 | 15 170.41 | 17 577.39 | 17 787.12 |

| Balance sheet total (assets) | 26 410.62 | 30 744.01 | 30 581.92 | 40 852.67 | 40 544.77 |

| Net debt | 11 421.35 | 10 774.78 | 10 616.28 | 17 793.49 | 17 151.33 |

| Profitability | |||||

| EBIT-% | |||||

| ROA | 1.9 % | 1.5 % | 1.6 % | 1.5 % | 1.4 % |

| ROE | 3.0 % | 1.2 % | 1.7 % | 0.2 % | -1.1 % |

| ROI | 2.0 % | 1.6 % | 1.7 % | 1.6 % | 1.4 % |

| Economic value added (EVA) | - 797.44 | -1 000.13 | -1 147.51 | -1 190.14 | -1 781.53 |

| Solvency | |||||

| Equity ratio | 42.2 % | 49.0 % | 49.6 % | 43.0 % | 43.9 % |

| Gearing | 102.7 % | 73.2 % | 70.4 % | 101.2 % | 96.4 % |

| Relative net indebtedness % | |||||

| Liquidity | |||||

| Quick ratio | 0.5 | 0.4 | 0.4 | 2.9 | 2.5 |

| Current ratio | 0.5 | 0.4 | 0.4 | 2.9 | 2.5 |

| Cash and cash equivalents | 17.47 | 246.96 | 68.55 | 1.19 | |

| Capital use efficiency | |||||

| Trade debtors turnover (days) | |||||

| Net working capital % | |||||

| Credit risk | |||||

| Credit rating | A | A | A | A | A |

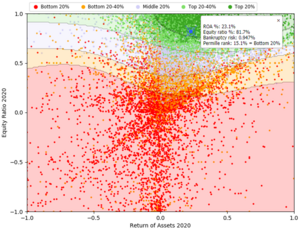

Variable visualization

Roles

Companies in the same industry

- Company information

- Financial data

- Credit risk data

- All 400,000+ Danish companies

- Professional credit risk reports

- Create your own estimates for any company

- Valuation analysis

- All 400,000+ Danish companies

- See instructions

... and more!

No registration needed.