Ålekistevej 208 ApS

Credit rating

Company information

About Ålekistevej 208 ApS

Ålekistevej 208 ApS (CVR number: 38766503) is a company from AARHUS. The company recorded a gross profit of -559.7 kDKK in 2023. The operating profit was -2014.7 kDKK, while net earnings were -920 kDKK. The profitability of the company measured by Return on Assets (ROA) was -7.9 %, which can be considered poor and Return on Equity (ROE) was -13.8 %, which can be considered poor. The equity ratio, a key indicator for solidity, stood at 26.7 %, a level that can be considered to be low. This means a higher proportion of debt in its capital structure, indicating a greater reliance on borrowed funds. Ålekistevej 208 ApS's liquidity measured by quick ratio was 10.4 which is at a very high level. Thus, the company demonstrates exceptional financial stability, possessing a significant surplus of liquid assets over its short-term liabilities.

Financial information

See financialsGross profit (kDKK)

EBIT (kDKK)

Profitability

Solidity

Key figures (kDKK)

See financials| 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|

| Volume | |||||

| Net sales | |||||

| Gross profit | -7.68 | -19.78 | 1 349.95 | 1 400.54 | - 559.67 |

| EBIT | 1 531.50 | -19.78 | 2 712.23 | 1 930.46 | -2 014.67 |

| Net earnings | 594.65 | -15.43 | 1 053.06 | 845.62 | - 920.03 |

| Shareholders equity total | 5 264.49 | 5 249.06 | 6 302.12 | 7 147.74 | 6 227.71 |

| Balance sheet total (assets) | 5 516.06 | 6 936.02 | 23 836.53 | 26 219.73 | 23 294.12 |

| Net debt | -30.00 | 24.29 | 12 992.39 | 15 480.45 | 15 446.05 |

| Profitability | |||||

| EBIT-% | |||||

| ROA | 54.8 % | -0.3 % | 17.6 % | 7.7 % | -7.9 % |

| ROE | 22.3 % | -0.3 % | 18.2 % | 12.6 % | -13.8 % |

| ROI | 55.6 % | -0.4 % | 20.0 % | 8.4 % | -8.2 % |

| Economic value added (EVA) | 1 198.13 | - 278.46 | 1 851.97 | 1 252.42 | -2 706.50 |

| Solvency | |||||

| Equity ratio | 95.4 % | 75.7 % | 26.4 % | 27.3 % | 26.7 % |

| Gearing | 0.5 % | 226.2 % | 225.8 % | 258.4 % | |

| Relative net indebtedness % | |||||

| Liquidity | |||||

| Quick ratio | 0.5 | 0.0 | 0.1 | 1.8 | 10.4 |

| Current ratio | 0.5 | 0.0 | 0.1 | 1.8 | 10.4 |

| Cash and cash equivalents | 30.00 | 1 261.74 | 656.04 | 648.86 | |

| Capital use efficiency | |||||

| Trade debtors turnover (days) | |||||

| Net working capital % | |||||

| Credit risk | |||||

| Credit rating | BBB | BBB | A | A | BBB |

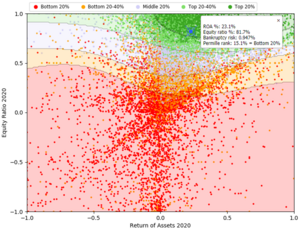

Variable visualization

Companies in the same industry

Create your own estimates for any company

Valuation analysis

See instructions

... and more!

No registration needed.